We hope you are staying safe and healthy. Today, we are writing to you regarding the coronavirus as it relates to the upcoming tax deadlines for the IRS and CT. During the last few weeks, we have been contacting our state and federal representatives, senators and lobbyists to request tax filing and payment relief due to the unprecedented disruptions and challenges caused by the spread of this virus. Finally, last night (Sunday 3/15) Connecticut’s Gov. Lamont held a press conference in which he extended CT state tax filing and payment deadlines for the 2019 partnerships and S-corps. Additionally, our governing body, the AICPA, issued a statement saying that they expect the IRS to extend the April 15 personal tax filing deadline by possibly 90 days and waive penalties and interest associated with payments for most taxpayers. CT DRS Press Release

During this time of social distancing, we ask our clients to please make phone or virtual consultation appointments. If you are able to, please send us your tax documents electronically (we can send you a secure upload link) or mail them to us as our office is currently closed to visitors.

We are being faced with a turbulent financial time. The SBA (Small Business Administration) should have liquidity to make loans to Connecticut businesses to pay for expenses incurred as a result of distress caused by the coronavirus. Please read this for instructions on how to apply for aid.

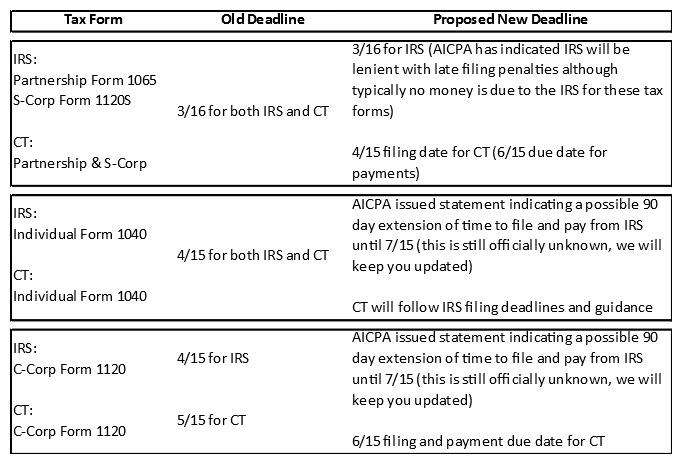

Below is a chart with the upcoming proposed and extended common filing deadlines. We will update you when we receive more guidance and final filing and payment deadlines from the IRS.