We at Francis S. Infurchia & Company are working remotely starting today, March 23. While we have closed the physical office to visitors and are eliminating in-person meetings for the time being we remain fully operational and we are available virtually and by phone and email. If you haven’t already, and are able to, please scan and electronically send all tax documents to us- we can provide a secure portal for you to upload this information.

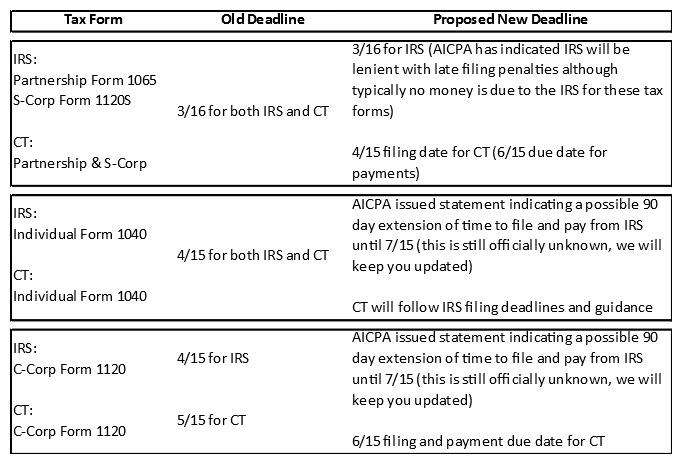

Over the weekend, the IRS extended the tax filing and payment deadlines from April 15 to July 15. This extension of time applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax. In addition, it appears that Q1 2020 estimated tax payments (normally due on 4/15) are included in this relief. Click here for the IRS announcement

The CT Department of Revenue Services is following the IRS tax deadlines and in addition, has included the Q2 2020 estimated tax payment deadline (normally due on 6/15) in the 90 day extension to July 15. Click here for the CT press release

To check on your individual state’s updated tax filing deadlines you can click here (updated daily).

We hope you stay safe and healthy during these uncertain times. Please let us know if you have any questions.