- Employ no more than 300 employees per physical location;

- Have used or will use the full amount of their first PPP loan; and

- Demonstrate at least a 25% reduction in gross receipts in the first, second, or third quarter of 2020 relative to the same 2019 quarter. Applications submitted on or after Jan. 1, 2021 are eligible to utilize the gross receipts from the fourth quarter of 2020.

Category: Small Business Loans

PPP Revised Forgiveness Application & New IFR

June 19, 2020

The SBA released new forgiveness applications (yes, plural) to incorporate the most recent legislation from the Paycheck Protection Program Flexibility Act of 2020 which became law on June 5th. The following was summarized by our friends at the Journal of Accountancy published by the AICPA.

Keep in mind that the deadline to apply for PPP loans remains June 30. After that date, no new PPP loan applications will be accepted.

Two new forgiveness applications were released

The revised PPP Loan Forgiveness Application and instructions include a number of notable items. Among them are:

- Health insurance costs for S corporation owners cannot be included when calculating payroll costs; however, retirement costs for S corporation owners are eligible costs.

- Safe harbors for excluding salary and hourly wage reductions and reductions in the number of employees (full-time equivalents) from loan forgiveness reductions can be applied as of the date the loan forgiveness application is submitted. Borrowers don’t have to wait until Dec. 31 to apply for forgiveness to use the safe harbors.

- Borrowers that received loans before June 5 can choose between using the original eight-week covered period or the new 24-week covered period.

Click the links to access the revised PPP forgiveness application (link) and instructions (link)

The EZ PPP Loan Forgiveness Application requires fewer calculations and less documentation than the full application. The EZ application can be used by borrowers that:

- Are self-employed and have no employees;

- Did not reduce the salaries or wages of their employees by more than 25% and did not reduce the number or hours of their employees; or

- Experienced reductions in business activity as a result of health directives related to COVID-19 and did not reduce the salaries or wages of their employees by more than 25%.

Click the links to access the EZ PPP forgiveness application (link) and instructions (link)

New Interim Final Rule (IFR)

The SBA issued rules (link) Tuesday night for determining payroll costs and owner compensation in calculating PPP loan forgiveness under the new 24-week covered period.

- The PPP allows loan forgiveness for payroll costs — including salary, wages, and tips — for up to $100,000 annualized per employee, or $15,385 per individual over the eight-week period. The new interim final rule establishes the 24-week maximum for full loan forgiveness at $46,154 per individual.

- While the employee compensation limit for the 24-week period is three times the eight-week limit, the interim final rule does not do the same with the owner compensation replacement for businesses that file Schedule C, Profit or Loss From Business, or Schedule F, Profit or Loss From Farming, tax returns. For those businesses, forgiveness for the owner compensation replacement is calculated for the eight-week period as 8 ÷ 52 × 2019 net profit, up to a maximum of $15,385. For the 24-week period, the forgiveness calculation is limited to 2.5 months’ worth (2.5 ÷ 12) of 2019 net profit, up to $20,833.

The interim final rule also modifies earlier guidance to account for changes included in the Payroll Protection Flexibility Act.

- The minimum term for PPP loans is raised to five years for all loans made on or after June 5. For loans made before June 5, the two-year minimum maturity remains in effect unless both the borrower and the lender agree to extend it to five years.

- The proportion of PPP funding that must be used on payroll costs to qualify for full forgiveness drops to 60% from 75%.

- The application deadline for PPP loans remains June 30.

We are available to discuss this newly released information. Please call us at 203-852-7088 or email if you have questions.

This PPP loan guidance and information continues to change on a daily basis and as it does, we will keep you up to date.

PPP – Senate Passed New Forgiveness Extensions & Relief

After hours on Wednesday, June 3 the Senate unanimously passed the Paycheck Protection Flexibility Act (link) which grants extension and relief measures for those who received PPP loans. This is expected to be signed into law by the President shortly.

The following is a summary of the legislation’s main points compiled by the AICPA:

- PPP borrowers can choose to extend the eight-week period to 24 weeks, or they can keep the original eight-week period. This flexibility is designed to make it easier for more borrowers to reach full, or almost full, forgiveness.

- The payroll expenditure requirement drops to 60% from 75%.but is now a cliff, meaning that borrowers must spend at least 60% on payroll or none of the loan will be forgiven. Currently, a borrower is required to reduce the amount eligible for forgiveness if less than 75% of eligible funds are used for payroll costs, but forgiveness isn’t eliminated if the 75% threshold isn’t met.

- Borrowers can use the 24-week period to restore their workforce levels and wages to the pre-pandemic levels required for full forgiveness. This must be done by Dec. 31, a change from the previous deadline of June 30.

- The legislation includes two new exceptions allowing borrowers to achieve full PPP loan forgiveness even if they don’t fully restore their workforce. Previous guidance already allowed borrowers to exclude from those calculations employees who turned down good faith offers to be rehired at the same hours and wages as before the pandemic. The new bill allows borrowers to adjust because they could not find qualified employees or were unable to restore business operations to Feb. 15, 2020, levels due to COVID-19 related operating restrictions.

- Borrowers now have five years to repay the loan instead of two. The interest rate remains at 1%.

- The bill allows businesses that took a PPP loan to also delay payment of their payroll taxes, which was prohibited under the CARES Act.

You can access the PPP Loan Forgiveness Application, instructions and worksheets here (link).

The AICPA has provided a thorough and free loan forgiveness Excel calculator which is updated as guidance is released, which can be found here (link)

We are available to discuss this newly released information. Please call us at 203-852-7088 or email if you have questions.

This PPP loan guidance and information continues to change on a daily basis and as it does, we will keep you up to date.

PPP Loan – Forgiveness Instructions & Application

PPP Loan – Certification of Need – New Info

PPP Loan – Forgiveness & Certification of Need

SBA Forgivable Loan – Paycheck Protection Program (PPP)

There is much news about the Paycheck Protection Program (PPP), which is the forgivable loan backed by the SBA. Below is the relevant information you need in order to apply. All of this information is accessible by going to SBA Website – PPP section

PPP Borrower Guide Information sheet – issued by Dept of Treasury: Click Here

PPP Application: Click Here

Lenders will begin processing applications on April 3, according the SBA

It is our understanding and that of the AICPA that virtually all banks and credit unions will be able to process these applications, but you should check with your local banker and discuss this Lenders Guide to be sure.

We remain available to assist in any way we can. Please feel free to share this information.

Sincerely,

Francis S. Infurchia & Company, LLC

Sick & Family Leave Acts – Summary

Greetings from home!

In the last few weeks with all of the tax deadlines extended, what has typically been ‘tax season’ for all of us has quickly morphed into coronavirus response and mitigation. We have been researching and learning about the new paid leave acts, tax credits, stimulus packages, SBA loans and the no-interest CT bridge loans. In addition, we have been taking continuing education and attended town-hall conference calls with our state representatives and the SBA in order to pass along pertinent information to you.

This is another one of a many-part series of communications you will receive from us regarding new tax benefits and mitigation opportunities that may be available. Please share this information with others.

This post will focus solely on the Families First Coronavirus Response Act; specifically, the two parts of this act which provide no-cost to employer paid sick, medical and family leave to employees though tax credits claimed on payroll tax returns. You can click the below links to see our limited analysis regarding these new acts.

Emergency Family and Medical Leave Expansion Act

Paid Sick, Emergency Family and Medical Leave for Self-Employed

Tax Deadline Extensions due to Coronavirus

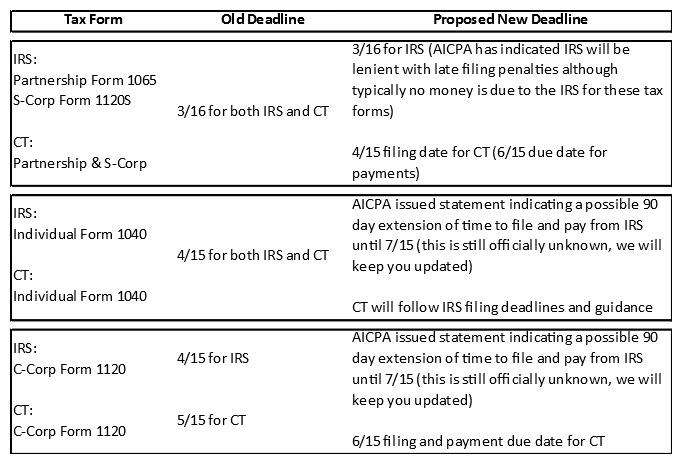

We hope you are staying safe and healthy. Today, we are writing to you regarding the coronavirus as it relates to the upcoming tax deadlines for the IRS and CT. During the last few weeks, we have been contacting our state and federal representatives, senators and lobbyists to request tax filing and payment relief due to the unprecedented disruptions and challenges caused by the spread of this virus. Finally, last night (Sunday 3/15) Connecticut’s Gov. Lamont held a press conference in which he extended CT state tax filing and payment deadlines for the 2019 partnerships and S-corps. Additionally, our governing body, the AICPA, issued a statement saying that they expect the IRS to extend the April 15 personal tax filing deadline by possibly 90 days and waive penalties and interest associated with payments for most taxpayers. CT DRS Press Release

During this time of social distancing, we ask our clients to please make phone or virtual consultation appointments. If you are able to, please send us your tax documents electronically (we can send you a secure upload link) or mail them to us as our office is currently closed to visitors.

We are being faced with a turbulent financial time. The SBA (Small Business Administration) should have liquidity to make loans to Connecticut businesses to pay for expenses incurred as a result of distress caused by the coronavirus. Please read this for instructions on how to apply for aid.

Below is a chart with the upcoming proposed and extended common filing deadlines. We will update you when we receive more guidance and final filing and payment deadlines from the IRS.